If you want to win in today’s fast‑moving markets, insight beats instinct. The most successful teams don’t guess at strategy — they systematically research competitors to uncover what works, what doesn’t, and where the market is headed. In this guide on how to do a competitive analysis, we’ll walk you through smart ways to gather real competitive intelligence, benchmark your business against others, and turn those insights into strategic decisions that fuel growth, sharpen your positioning, and spark innovation.

What Is a Competitive Analysis?

Competitive analysis is a research process used to assess your competitors and understand industry dynamics. It goes beyond simply knowing who’s in the market — it helps you uncover what works, what doesn’t, and where opportunities lie.

When done effectively, competitor mapping directly supports business strategy outcomes: improving market positioning, guiding product decisions, and shaping effective go‑to‑market plans. It’s a critical tool for strategic decision-making and growth, providing insights that help your business stay ahead, respond to market changes, and make informed, high-impact choices.

When to Use a Competitive Analysis

Competitive analysis isn’t just a one-time task — it’s a strategic tool that informs multiple aspects of your business. Use it when you want to:

Assess entering a market: Understand the competition and uncover opportunities to differentiate your business before entering a new market.

Identify product development opportunities: Spot gaps in the market and create products that meet unmet customer needs or offer unique features.

Determine pricing strategy: Analyze competitor pricing to develop competitive, market-aligned pricing that delivers value to customers.

Shape marketing strategy: Highlight your unique value proposition and craft campaigns that set you apart from competitors.

Refine sales strategy: Learn from competitors’ sales approaches to improve your processes and better serve customers.

Explore partnerships and collaborations: Identify potential partners and understand how strategic relationships can strengthen your position.

How to Conduct a Competitive Analysis in 5 Steps

Step 1: Identify Your Competitors

The first step in any competitive market analysis is knowing who you’re up against. This includes both direct competitors — businesses offering similar products or services to the same audience — and indirect competitors — those solving the same customer problem in a different way.

To find them, use multiple approaches:

Search engines: Look for companies appearing in top results for your key products or services.

Social media: Check who’s active, engaging, and building a following in your niche.

Industry reports: Explore market research, trade publications, and analyst insights for emerging players.

Analytics tools: Platforms like SimilarWeb or SEMrush can reveal competitors based on web traffic, keywords, and audience overlap.

Once you have a list, prioritize your competitors based on factors like market share, growth potential, relevance to your target audience, and strategic threat. Focus first on the players who matter most — those whose moves could directly influence your business decisions.

Step 2: Gather Data

Once you know your competitors, it’s time to collect actionable information. The goal is to understand how they operate, what resonates with customers, and where gaps exist.

Key sources of competitive data:

Websites, marketing collateral, and pricing pages: Study product offerings, messaging, and positioning.

Social media, content marketing, and SEO footprint: Track engagement, campaigns, content strategy, and search visibility.

User reviews and customer feedback: Learn what customers love or dislike, and identify opportunities to improve.

Public financials (if available): Revenue, growth trends, and investment patterns reveal market strength and strategy.

Analytics tools: Platforms like SimilarWeb, SEMrush, Ahrefs, and others help uncover traffic sources, keywords, and competitor performance metrics.

Step 3: Choose and Apply Competitor Analysis Frameworks

With your data in hand, the next step is to organize and analyze it using proven frameworks. These tools turn raw information into actionable insights, helping you see patterns, gaps, and opportunities clearly.

- SWOT Analysis: Evaluate competitors’ strengths, weaknesses, opportunities, and threats to understand where they excel and where you can gain an advantage.

- Porter’s Five Forces: Examine industry structure and competitive intensity, including threats from new entrants, substitutes, buyer and supplier power, and rivalry.

- Perceptual Mapping: Visualize competitor positioning based on key factors like price, quality, or customer perception, making it easy to spot market gaps.

- Business Model Canvas: Compare value propositions, revenue models, customer segments, and operational logic to identify strategic differences.

- BCG matrix: Assess market position and portfolio strength to determine which products or business units deserve investment or attention.

- Strategic Group Analysis: Plot competitors with similar strategies or resources to cluster them, revealing opportunities to differentiate.

- Advanced Models (optional): For deeper insights, consider Six Forces, Delta Model, or competitor price analysis to refine pricing and strategy decisions.

Using these frameworks in combination with visual tools like competitive analysis charts and diagrams makes it easier to communicate insights, track patterns, and identify actionable strategies for growth.

Step 4: Analyze and Synthesize Insights

After gathering data and applying frameworks, the next step is to turn raw information into clear, actionable insights. This is where patterns emerge and strategy starts to take shape.

How to compare competitor findings with your own business:

Look at strengths, weaknesses, opportunities, and threats side by side.

Identify areas where competitors excel and where your business has an advantage.

Highlight gaps that represent opportunities for growth or differentiation.

Tools to make insights visual and actionable:

- Prioritization matrix: Rank competitor factors and opportunities by impact and feasibility to focus on what matters most.

- Competitive analysis dashboards and charts: Visualize key metrics, trends, and comparisons to make insights easy to digest for your team.

Synthesizing insights in this way ensures that your competitive analysis translates into informed decisions, helping you act strategically rather than reactively.

Step 5: Turn Insights into Strategy

Collecting and analyzing competitor data is only valuable if it guides action. Use the insights you’ve gathered to make informed business decisions that give you a competitive edge.

How to apply insights:

Adjust your product roadmap: Prioritize features or improvements that address gaps competitors are leaving open.

Refine messaging and positioning: Highlight your unique value in ways competitors haven’t.

Optimize pricing strategies: Align your pricing with market expectations and competitor benchmarks.

Always tie decisions to KPIs and measurable goals so you can track impact and continuously improve. Turning analysis into strategy ensures your business doesn’t just keep up — it stays ahead.

Why Use Creately to Perform Your Competitive Analysis

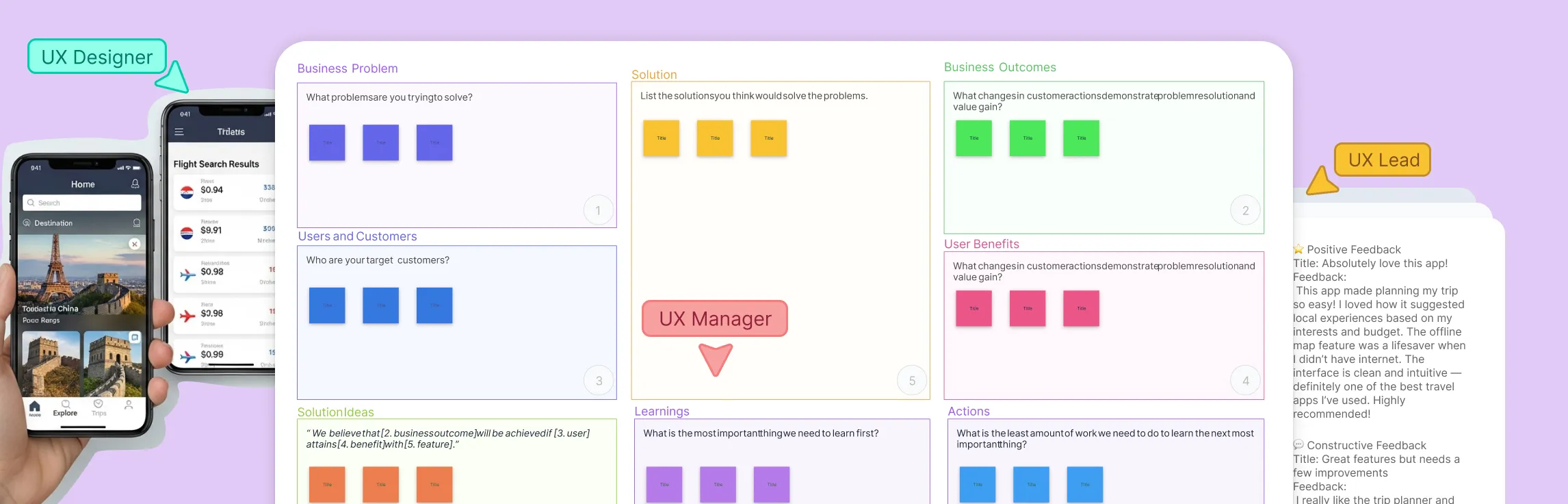

Now that you know how to do a competitive analysis, let’s look at how to do it more effectively with Creately. Competitive analysis can quickly become messy — spreadsheets, notes, screenshots, and diagrams scattered everywhere. Creately simplifies the process, making it visual, collaborative, and professional.

Powerful templates: Ready-made SWOT matrices, perceptual maps, Porter’s Five Forces, and product comparison charts help you structure your analysis instantly.

Centralized workspace: Store competitor data, pricing, notes, screenshots, and links in one organized visual canvas for easy updates and clear insights.

Insightful visualizations: Transform raw data into charts, grids, and diagrams with color coding, icons, and layouts that make patterns and opportunities easy to spot.

Real-time collaboration: Work seamlessly with your team — comment, refine insights, and track progress with statuses like Draft, In Progress, and Final.

Easy export and sharing: Download diagrams as PNG, PDF, or SVG or link charts directly to project plans and strategy documents, ensuring insights turn into action.

Free Competitor Analysis Templates

Now that you know the competitor analysis definition, how to write a competitive analysis, and competitive analysis methodology, here are some templates to get you started.

Competitor Matrix

Competitor Profile Template

Competitive Matrix Template

Competitive Intelligence Mind Map

7Ps Competitor Review Template

Porter’s Five Forces Competitor Chart Template

Common Mistakes and How to Avoid Them

Even the most thorough competitive analysis can go off track if you fall into common pitfalls. Here’s how to avoid them:

Focusing only on direct competitors: Ignoring indirect competitors or substitutes can leave you blind to market shifts. Always consider the broader competitive landscape.

Relying on outdated data: Markets move fast. Use current sources and update your analysis regularly to keep insights relevant.

Overloading with information: Collecting too much data without structure can overwhelm your team. Use frameworks and visual tools like charts and dashboards to keep it clear.

Ignoring actionable insights: Data is only valuable when it informs decisions. Translate findings into strategy, goals, and measurable actions.

Skipping prioritization: Treating all competitors and insights as equal can waste time. Focus on what matters most to your business and market impact.

Neglecting continuous monitoring: Competitive analysis isn’t a one-time project. Set up processes to track competitors, trends, and market changes consistently.

FAQs on Conducting a Competitor Analysis

What should I do with the insights gained from a competitive analysis?

How often should I conduct or update my competitive analysis?

How do you analyze the data collected during a competitive analysis, and what are some key factors to consider?

What are the main types of competitors in the market?

What are some examples of competitive analysis?

How to present a competitor analysis?

What is the best tool to conduct a competitive analysis?